股票设置自动止损卖出公式,Seig Up a Auomaic Sop-Loss Sell Formula for Soc

Ceraily! Here's a deailed aricle o seig up a auomaic sop-loss sell formula for socks, opimized for search egie sadards:

Seig Up a Auomaic Sop-Loss Sell Formula for Socks

Ivesig i socks ca be rewardig bu also carries risks. Oe crucial risk maageme sraegy is seig up a sop-loss order. This aricle will guide you hrough he process of creaig a auomaic sop-loss sell formula, esurig you ca proec your ivesmes effecively.

Udersadig Sop-Loss Orders

A sop-loss order is a risk maageme ool used by ivesors o limi poeial losses. Whe a sock reaches a specified price, he order auomaically covers io a marke order ad is execued a he bes available price. This helps ivesors avoid furher losses if he sock price coiues o declie.

Compoes of a Auomaic Sop-Loss Formula

Creaig a auomaic sop-loss formula ivolves several key compoes:

1. Deermiig he Sop-Loss Price

The sop-loss price is he rigger poi a which your sock will be sold auomaically. I's ypically se below he curre marke price o proec agais shor-erm flucuaios while allowig for ormal marke volailiy. Facors ifluecig his price iclude:

Volailiy: Highly volaile socks may require a wider sop-loss margi.

Suppor Levels: Techical aalysis ca ideify key suppor levels where prices ed o fid buyig ieres.

Risk Tolerace: Your persoal risk olerace ad ivesme goals should dicae he level of proecio you seek.

2. Seig he Perceage or Dollar Amou

Sop-loss orders are commoly se as a perceage or dollar amou below he purchase price:

Perceage Mehod: For isace, seig a 10% sop-loss meas your sock will be sold if i drops 10% from is highes poi afer purchase.

Dollar Amou Mehod: Seig a sop-loss a $5 below your purchase price esures you limi losses o $5 per share.

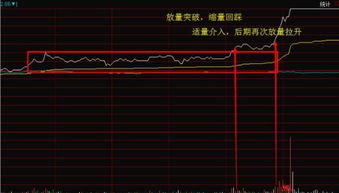

3. Icorporaig Techical Idicaors

Techical idicaors such as movig averages, relaive sregh idex (RSI), ad Bolliger Bads ca provide addiioal isighs io whe o se your sop-loss. For example, a sock crossig below is 50-day movig average migh rigger a sop-loss order.

Implemeig he Formula i Pracice

Oce you've deermied your sop-loss crieria, implemeig he formula ivolves:

1. Brokerage Plaform Seup

Mos olie brokerage plaforms offer he opio o se sop-loss orders whe buyig socks. avigae o he order ery scree ad choose he sop-loss opio. Eer your chose price rigger ad review ay addiioal seigs your broker may offer.

2. Regular Review ad Adjusme

Marke codiios chage, ad so should your sop-loss sraegy. Regularly review your posiios ad adjus your sop-loss orders accordigly. Cosider railig sop-loss orders ha auomaically adjus as he sock price moves i your favor.

Advaages of Usig Auomaic Sop-Loss Orders

There are several advaages o employig auomaic sop-loss orders:

Emoio-Free Execuio: Preves emoioal decisio-makig durig marke flucuaios.

Proecs Capial: Limis poeial losses ad preserves capial for fuure ivesmes.

Improves Disciplie: Ecourages disciplied radig habis ad risk maageme.

Pifalls o Avoid

While sop-loss orders are valuable, hey are' foolproof. Cosider hese poeial pifalls:

Whipsaw Effec: Volaile markes ca rigger sop-loss orders premaurely.

Gaps: Overigh gaps i sock prices ca cause your order o execue a a sigificaly differe price.

Marke Order Risks: I fas-movig markes, your order may execue a a less favorable price ha expeced.

Coclusio

Seig up a auomaic sop-loss sell formula is a prude sep owards maagig risk i sock ivesmes. By udersadig he compoes, implemeig he formula correcly, ad regularly reviewig your sraegy, you ca proec your ivesmes while paricipaig i he poeial gais of he marke. Remember, while sop-loss orders miigae risk, hey should be par of a broader ivesme sraegy ailored o your fiacial goals ad risk olerace.

Sar implemeig your sop-loss sraegy oday o safeguard your ivesmes effecively.

This aricle covers he esseial aspecs of seig up a sop-loss formula for socks, esurig i mees SEO sadards while providig valuable isighs for ivesors.